A year ago, the banking sector was awash with excess liquidity of around Tk1,27,000 crore, while it stood at around Tk82,000 crore at the end of January this year, which means around Tk45,000 crore has been disbursed during the period.

According to the Bangladesh Bank data, the surplus money has been channeled through the private commercial banks and they are now running out of money for lending.

Now, the question is why the banks have been facing liquidity crunch within a few months from a position of liquidity excess?

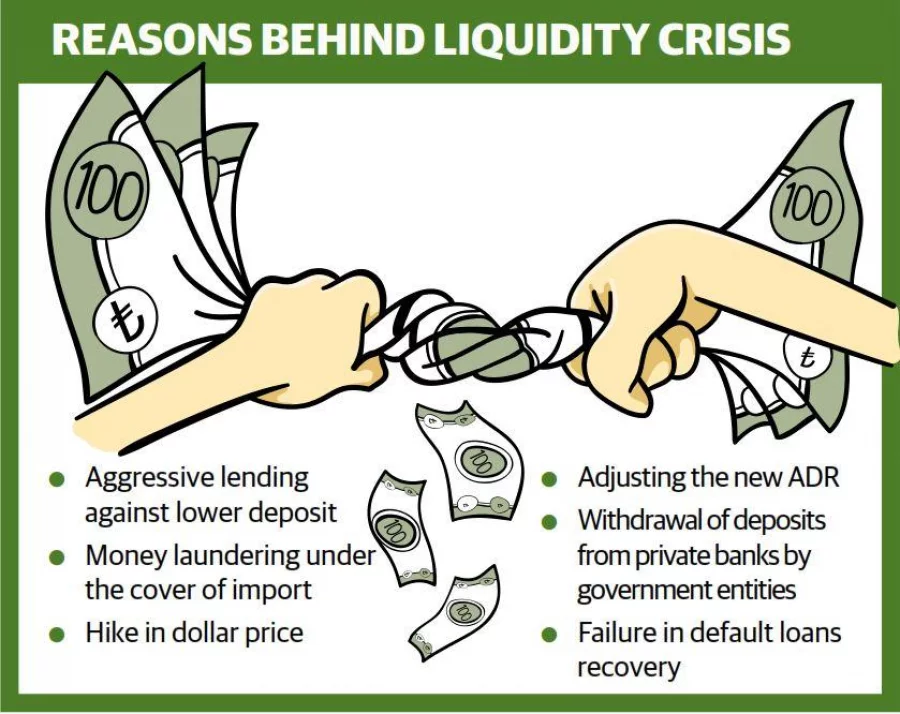

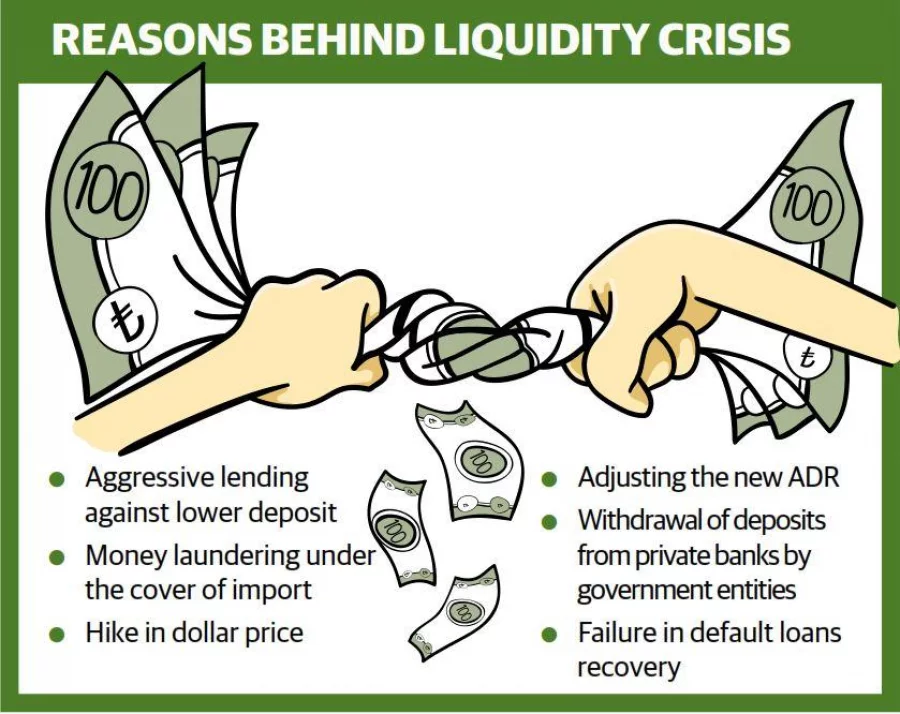

Economists, bankers and experts blamed aggressive lending against lower deposit, money laundering under the cover of import, hike in dollar price, adjusting the new advance deposit ratio (ADR), withdrawal of deposits, and failure in default loans recovery for the crisis.

The origins of the crisis

According to the central bank data, banks have received a total deposit of around Tk85,000 crore, while they disbursed around Tk1,25,000 crore between January and December 2017.

During this period, the depositors were interested in investing in National Saving Certificates as the deposit interest of banks was too low.

Over the next few months, the import of the country swelled while the export earnings and remittance lagged behind the import bills.

The trade deficit stood at $8.62 billion at the end of December 2017 due to the soaring demand for imports from businesses, the central bank said in its data.

The banks have to pay the import bills through dollars and the Bangladesh Bank sold the greenback worth Tk11,000 crore to the private banks in the previous year.

Moreover, the crisis has deepened following the scams of some new generation banks, which created panic among the depositors and they (depositors) have withdrawn their deposits. Some government organizations also withdrew their deposits from the private banks, which fuelled the crisis as well.

Meanwhile, the central bank has ordered the private banks to reduce their Advance-Deposit Ratio or ADR (83.5% for conventional and 89% for Islamic banks) with a view to controlling the aggressive lending.

“The central bank has lowered the ceiling of the ADR, for which we have to adjust Tk20,000 crore by next June. Meanwhile the government organizations are withdrawing their deposits from our banks. These have led to the liquidity crisis,” a managing director of a private bank told the Dhaka Tribune.

He said: “While we are fighting with liquidity crisis, the government organizations are depositing their money to the state-owned banks withdrawing from private banks. They have only 25% of their deposits in private banks, despite the private sector controlling over 70% of banking market share in the country. This trend should be stopped and the proprtion of government’s body’s deposit at the private banks should be 50%.”

Sources said, the private banks are now queuing at the door of state-owned banks for collecting deposits.

Some private banks including the Eastern, Brac, The City, Southeast and Dhaka Bank have appealed to the Sonali Bank for inter-bank deposit offering 10% interest rate.

Economists’ remarks

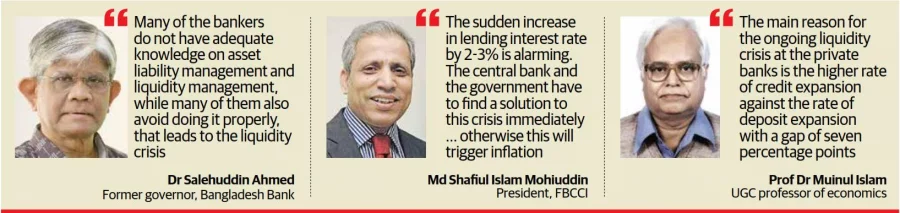

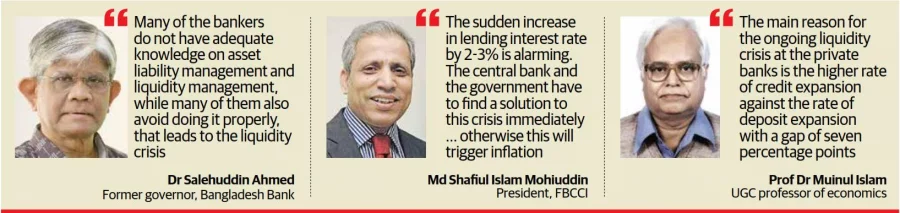

The University Grants Commission (UGC) Prof Dr Muinul Islam told the Dhaka Tribune: “The main reason for the ongoing liquidity crisis at the private banks is the higher rate of credit expansion against the rate of deposit expansion with a gap of seven percentage points. The credit expanded to 19%, while the deposit expanded to 12% at the end of December 2017.

“Another reason is that the depositors have moved towards National Savings Certificate instead of banks because of the higher interest rate in savings certificates. Moreover, the excessive expansion of Letter of Credit (LC) is also liable for the liquidity crisis. The growth rate of LC indicates money is being laundered from the country,” he added.

However, former Bangladesh Bank Governor Dr Salehuddin Ahmed blamed bankers for the crisis.

He told the Dhaka Tribune: “Many of the bankers do not have adequate knowledge on asset liability management and liquidity management, while many of them also avoid doing it properly, that leads to the liquidity crisis.”

To mitigate the crisis, the former central bank governor suggested the bankers expedite their default loan recovery process and increase the deposit collection by raising deposit interest rate instead of hiking the lending rate.

“In terms of increasing the deposits collection, the bankers always increase the lending rate. In this regard, they have to hike the deposit interest rate, but not the lending rate. They should maintain the spread between deposit and lending rate to 3-4%. To ease the pressure on lending rate, the banks have to reduce their operational cost and focus on lower profit.”

Salehuddin also sought the central bank’s intervention in mitigating the crisis and eliminating the fear of depositors.

Impact on businesses

Meanwhile, the lending rate has also increased by 2-3 percentage points in a few months, which has moved the credit interest rate beyond the “single digit interest rate” cherished by the business sector.

The businessmen, who were enjoying loans at 8-9% of interest rate for the last three to four years, are now bound to take loans at 10-12% interest rate. As part of the effort to maintain the ADR, some private banks are not disbursing the credit previously committed by them, and they (banks) are also taking back some amount from the businesses.

When contacted, the president of Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) Md Shafiul Islam Mohiuddin told the Dhaka Tribune: “The sudden increase in lending interest rate by 2-3% is alarming. The central bank and the government have to find out a solution to this crisis immediately. Otherwise,

the cost of doing business will increase and commodity prices will surge, which will trigger higher inflation.”

Moreover, the crisis has deepened following the scams of some new generation banks, which created panic among the depositors and they (depositors) have withdrawn their deposits. Some government organizations also withdrew their deposits from the private banks, which fuelled the crisis as well.

Meanwhile, the central bank has ordered the private banks to reduce their Advance-Deposit Ratio or ADR (83.5% for conventional and 89% for Islamic banks) with a view to controlling the aggressive lending.

“The central bank has lowered the ceiling of the ADR, for which we have to adjust Tk20,000 crore by next June. Meanwhile the government organizations are withdrawing their deposits from our banks. These have led to the liquidity crisis,” a managing director of a private bank told the Dhaka Tribune.

He said: “While we are fighting with liquidity crisis, the government organizations are depositing their money to the state-owned banks withdrawing from private banks. They have only 25% of their deposits in private banks, despite the private sector controlling over 70% of banking market share in the country. This trend should be stopped and the proprtion of government’s body’s deposit at the private banks should be 50%.”

Sources said, the private banks are now queuing at the door of state-owned banks for collecting deposits.

Some private banks including the Eastern, Brac, The City, Southeast and Dhaka Bank have appealed to the Sonali Bank for inter-bank deposit offering 10% interest rate.

Moreover, the crisis has deepened following the scams of some new generation banks, which created panic among the depositors and they (depositors) have withdrawn their deposits. Some government organizations also withdrew their deposits from the private banks, which fuelled the crisis as well.

Meanwhile, the central bank has ordered the private banks to reduce their Advance-Deposit Ratio or ADR (83.5% for conventional and 89% for Islamic banks) with a view to controlling the aggressive lending.

“The central bank has lowered the ceiling of the ADR, for which we have to adjust Tk20,000 crore by next June. Meanwhile the government organizations are withdrawing their deposits from our banks. These have led to the liquidity crisis,” a managing director of a private bank told the Dhaka Tribune.

He said: “While we are fighting with liquidity crisis, the government organizations are depositing their money to the state-owned banks withdrawing from private banks. They have only 25% of their deposits in private banks, despite the private sector controlling over 70% of banking market share in the country. This trend should be stopped and the proprtion of government’s body’s deposit at the private banks should be 50%.”

Sources said, the private banks are now queuing at the door of state-owned banks for collecting deposits.

Some private banks including the Eastern, Brac, The City, Southeast and Dhaka Bank have appealed to the Sonali Bank for inter-bank deposit offering 10% interest rate. To mitigate the crisis, the former central bank governor suggested the bankers expedite their default loan recovery process and increase the deposit collection by raising deposit interest rate instead of hiking the lending rate.

“In terms of increasing the deposits collection, the bankers always increase the lending rate. In this regard, they have to hike the deposit interest rate, but not the lending rate. They should maintain the spread between deposit and lending rate to 3-4%. To ease the pressure on lending rate, the banks have to reduce their operational cost and focus on lower profit.”

Salehuddin also sought the central bank’s intervention in mitigating the crisis and eliminating the fear of depositors.

To mitigate the crisis, the former central bank governor suggested the bankers expedite their default loan recovery process and increase the deposit collection by raising deposit interest rate instead of hiking the lending rate.

“In terms of increasing the deposits collection, the bankers always increase the lending rate. In this regard, they have to hike the deposit interest rate, but not the lending rate. They should maintain the spread between deposit and lending rate to 3-4%. To ease the pressure on lending rate, the banks have to reduce their operational cost and focus on lower profit.”

Salehuddin also sought the central bank’s intervention in mitigating the crisis and eliminating the fear of depositors.