From July 1 this year, the government is going to implement the much talked about VAT law using tech-based devices, but the National Board of Revenue (NBR) is yet to purchase the Electronic Fiscal Device (EFD) to ensure transparency in the VAT connection.

An EFD is a device which procures the digital record of every sale and instantly sends the data to a central server automatically, so as to prevent any chance of manipulation.

To bring the VAT calculation under the net of electronic coverage, there is a need for about 600,000 EFD machines.

The NBR recently floated a tender to purchase only 10,000 EFD machines, which are expected to be received by the end of July, while the new VAT law is going to be implement from the first day of the next fiscal year.

In such a situation, experts opined that the government may face problems in the beginning, and urged the authorities concerned to stay alert as the implementation of the law should not be postponed due to the unavailability of the machines.

CPD senior research fellow Towfiqul Islam Khan said: "EFDs are a critical pre-requisite for implementing the new VAT law. The government should provide the machines in phases as early as possible, to ensure proper VAT collection from local traders."

Earlier on May 13, the NBR issued a general order (GO) making EFDs mandatory, as part of the new VAT law to be implemented from July 1.

As per the order, 25 types of business outlets including restaurants, residential hotels, beauty parlours, branded clothing and departmental stores under the city corporation areas and district headquarters must use EFDs.

“As per the new VAT law, approximately 600,000 out of 3,000,000 local traders will need to using EFDs from the first day of the 2019-20 fiscal year, but the NBR is going to provide only 10,000 machines initially, leaving the majority traders to use the old VAT payment system,” said an NBR official, asking to remain anonymous.

He also said the government is the only authority that will provide the machines to traders at a "lowered price."

“On the other hand, the installation of the central NBR data server, which will keep sale-records sent from the EFDs through internet, is also not prepared yet,” he told Dhaka Tribune.

VAT Online Project Director Syed Mushfequr Rahman said server installation and other infrastructures were expected to be completed within one and a half months.

“Majority of the work is done and we hope the server will run from August,” he said, adding that they would also be able to set up 10,000 EFDs initially in different areas of Dhaka city including Dhanmondi, Ghulsan, Banani in the mean time.

A total 100,000 machines will be provided to traders throughout the country by December this year, and the rest will be provided in later phases, added Rahman.

He further said those who are not provided with EFDs will pay VAT by keeping their sales accounts manually. “The EFD is only for ensuring transparency, so that the traders cannot evade VAT collected from the consumers,” he said.

The NBR earlier made Electronic Cash Registers (ECRs) mandatory through issuance of a circular in 2011, but failed to implement the measure fully.

EFD is a more technologically advanced machine, which will gradually replace the ECRs.

Only 10,000 to 12,000 traders have been using ECRs till date, though approximately 700,000-800,000 are supposed to use the digital device, said NBR officials.

While placing the budget for FY2019-20 before the parliament on Thursday, Finance Minister AHM Mustafa Kamal said: “We are going to implement our long-awaited Value Added Tax and Supplementary Duty Act, 2012 from the coming fiscal year (2019-20) keeping the four rates including 15%, 10, 7.5% and 5%.”

However, several attempts to implement the act fell through previously amid protests from the business community, as they demanded multiple rates and some other reforms to the act.

Businessmen welcome the new VAT law

Businessmen have welcomed the new VAT law and said they do not have any objection with it, as the government kept multiple rates as demanded.

“We are welcoming the new VAT law and we think it will bring comfort to small businessmen,” said Shiekh Fazle Fahim, president of the Federation of Bangladesh Chambers of Commerce and Industries (FBCCI), while giving his reaction to the proposed budget in a press conference on Saturday.

He urged the government and authorities concerned not to harass businessmen while implementing the new VAT law, adding that they have no discord with the NBR.

Ensuring digital documentation a challenge

Apart from managing EFD for traders, including wholesalers and retailers, ensuring digital documentation for different companies and their automatic return filing will be a big challenge, said another NBR official seeking anonymity.

Currently, the companies are submitting VAT returns manually, declaring their turnover and payable VAT on their own. In such a situation, there is a scope for evading tax.

“Automation as per the new law will remove the scope for evading TAX,” he said, adding that the challenge is to ensure fairness by using only the NBR authorized software.

What is new in the VAT law?

The new VAT law is very little different from the old one (Value Added Tax Act 1991). Package VAT will be no longer in place from the upcoming fiscal year.

Besides, there will be four slabs - 15%, 10%, 7.5%, 5% - while previously there had been seven slabs: 2%, 3%, 4.5%, 5%, 7%, 10% and 15%.

However, rebate facilities will be available only for those who pay at a flat rate of 15%.

In the new proposed budget, the VAT-free annual turnover limit has been raised to Tk50 lakh from the existing Tk36 lakh.

The ceiling of turnover tax has been increased to Tk3 crore, at 4% from the existing 3%.

Contribution of VAT to revenue

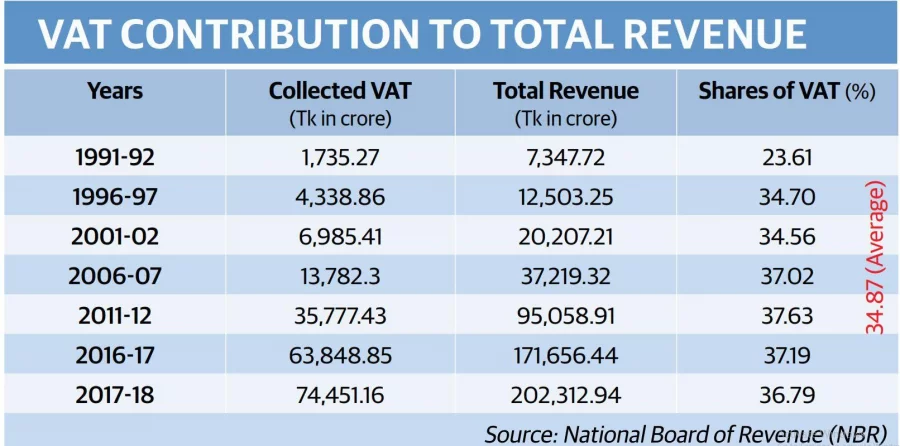

In the July-April period of the current fiscal year, the government earned Tk1,73,422 crore, of which the VAT contribution was Tk67,182 crore.

In the last fiscal year (FY2017-18), VAT contribution to the total revenue was 36.8%, and the ratio has remained at about 35% over the last couple of years.

The government collects VAT from four main sources: imports, local production, wholesale, and retail sale.

Among these sources, imports contribute almost 40% of the total VAT, while local trade and production contribute 60%.