The contribution of exports to Gross Domestic Product (GDP) has been shrinking over the years as lack of product diversification and sluggish private sector investment in the manufacturing industry hold back the momentum.

While the economy has been registering steady growth through the last decade, the negative contribution of shrinking exports to the GDP adversely affected desired employment generation in the job market, economists said.

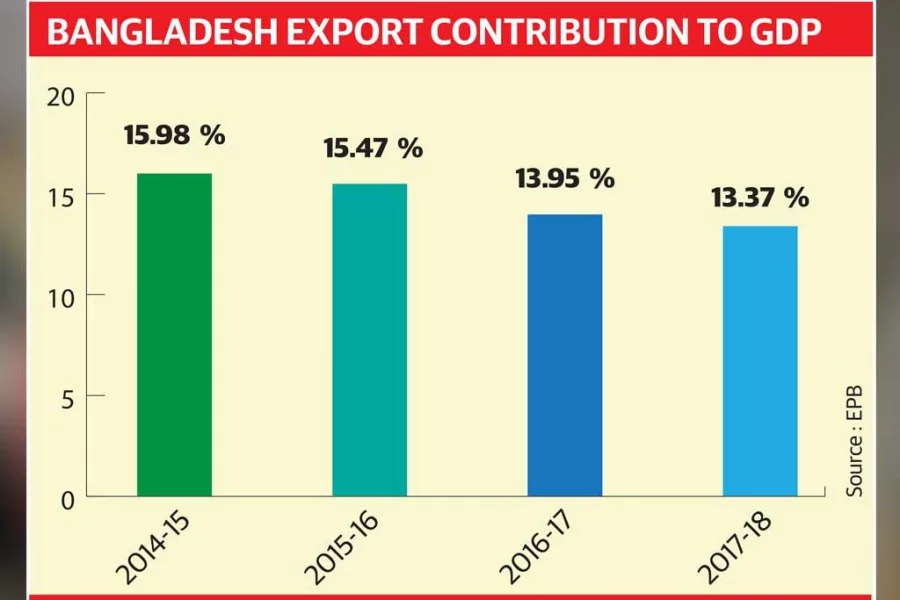

According to the latest data of Bangladesh Bureau of Statistics (BBS), the contribution of merchandise exports to the country’s GDP came down to 13.37% in fiscal year 2017-18 from 13.95% in FY 2016 -17.

In 2014-15, the contributing share of exports to the economy was 15.98%, which slid to 15.47%.

On the other hand, Bangladesh registered a 7.81% GDP growth in FY18, which was 7.28% the previous year.

In FY18, Bangladesh’s GDP was Tk22,504,793 million at current market prices, while overall export earnings from goods was Tk3,010,456.75 million.

The RMG sector, the lifeline of the economy, has contributed Tk2,513,471 million or 11.16% of GDP. The services sector contributed 56% of GDP, followed by industry at 18.99%, and 34.82% for the agriculture sector.

Sluggish private sector investment, discriminatory lack of policy support for the non-RMG export sector, higher dependence on certain products, and lack of business diversification are blamed for the downward trend in the contribution of exports to GDP, economists said.

Apparel makers had to invest a huge amount of money to improve safety standards as prescribed by the global retailer platforms, Accord and Alliance. As a result, new investments for expansion did not take place, Bangladesh Garment Manufacturers and Exporters Association (BGMEA) senior vice president Faruque Hassan told the Dhaka Tribune.

In addition, global apparel buyers are continuously cutting prices for apparel products. As a result, export earnings did not grow as expected, further dropping export contributions to GDP, said Hassan.

“Product diversification within the apparel sector is not happening due to shortage of land and lack of medium term financing. Besides, the lack of a skilled workforce for value added products and to run modern technology -based machinery also resulted in the downward contribution,” Zahid Hussain, World Bank Lead Economist in Bangladesh, told the Dhaka Tribune.

In non-RMG product diversification, trade policies are a big obstacle as they do not enjoy benefits similar to those in the RMG sector, said Hussain.

On top of that, appreciation of local currency which is less than its competing countries in the global market is another reason for the situation, denting Bangladesh’s competitive edge and also the job market , said the economist.

Investment is going through a slower pace as investors have adopted a wait-and see policy to make investment decisions ahead of national elections.

Since political uncertainty is a threat to completion of projects, industrialists are waiting to see the results of the next election before making investments, an industrialist said.

Ways forward

In recent years, the government has taken lots of initiatives such as reduction in bank interest rates and offering export subsidies so that investors are drawn to invest in basic industries that play a vital role in GDP contribution and creating employment in the economy.

Stakeholders and experts think effective implementation of stimulus initiatives would help enhance export activities and contribute to the economy.

“As a part of government export diversification efforts, currently the government is providing cash incentives to 35 products, including nine newly added products this year,” Commerce Minister Tofail Ahmed told the Dhaka Tribune.

Also, to boost private sector investment, the government is establishing 100 Special Economic Zones (SEZs). On completion of some of the SEZs, private sector investment would boom and export contributions to GDP will go up for sure, the minister hoped.

Timely and effective implementation of government projects undertaken to improve infrastructure deficits, will bring good results for the country's export oriented sector as well for the local economy, said Hussain.

The apparel sector enjoys special facilities such as bonded warehouses, back-to-back Letters of Credit (LCs,) and special treatment at ports, which non-RMG sectors do not enjoy . So, equal policies for all sectors is a must for their sustainable development and broadening the narrow export basket, said the economist.

“In addressing the issues,a better use of Export Development Funds (EDFs) can be a great tool to increase the export contribution to GDP. In this regard, attention should be given to the manufacturing sector which will increase the production base of industries,” ABM Azizul Islam, former finance advisor of a caretaker government told the Dhaka Tribune.

Since the government made huge investments in infrastructure development, the country will soon reap the benefits. But the private sector will have to come forward with new investment plans, said the economist.

On top of that, the Special Economic Zones (SEZs) will be an effective driving force in attracting investments from home and abroad, which would ultimately help in reaching the desired contribution of exports, said Islam.

But the government has to prioritize the sectors and pave ways to increase the export volume by offering policy support to the emerging sectors, he added.

According to the Bangladesh Bureau of Statistics (BBS) data, Bangladesh’s investment ratio to GDP stood at 31.23% in the last fiscal year, of which 23.10% came from the private sector, and 7.97% from public investment.

Against this backdrop, Finance Minister AMA Muhith set a target of scaling up total investments to 33.54% of GDP for the current fiscal year.

Of the total, private investment has been projected at 25.15% of GDP, while 8.39% is estimated to come from public investment.